The battle for the Kingdom’s highest Court is reportedly over, as Activist Investor Nelson Peltz withdraws his proxy fight to join Disney’s Board of Directors after CEO Bob Iger outlined a massive reorganization of The Company during the Q1 2023 Earnings Call.

But how much damage in terms of voting proxy has already been done?

Trian Partners founder Nelson Peltz says his proxy fight with Disney is over.pic.twitter.com/JUzskAeAPT

— Ashley Carter (@AshleyLCarter1) February 9, 2023

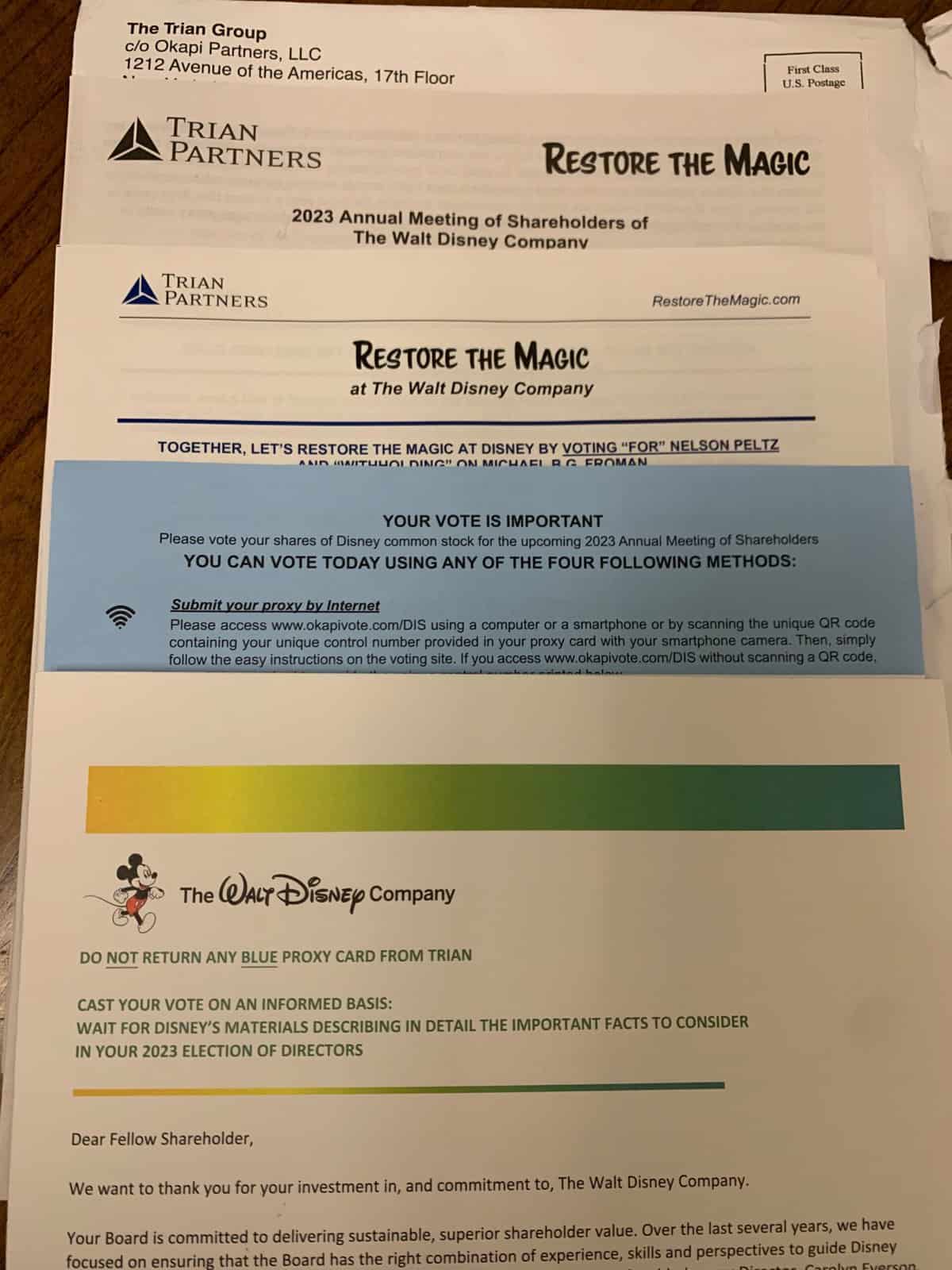

Shareholders of The Walt Disney Company received two very important items via “snail mail” this week. The first is a large packet from Trian Partners Master Fund, L.P. with a blue proxy card, and the second is a letter from Disney saying, quite bluntly, “DO NOT RETURN ANY BLUE PROXY CARD FROM TRIAN.”

Delivered under the call to action “Restor the Magic at The Walt Disney Company,” Peltz and his firm pleaded their case to the individual Disney stockholder and asked for their proxy vote. The plea letter was mailed out to stockholders on February 2, saying, “Together, let’s restore the magic at Disney by voting “for” Nelson Peltz and “withholding” on Michael B.G. Froman.”

For those who have kept up with this story, Peltz’s written argument reads much of the same as what he has spoken in television interviews. Reminding stockholders that Disney lost $120 billion in market value in 2022 alone, earnings per share have declined by 50% since 2018, and the near-60-year-old dividend still has not returned.

Peltz’ also argued that the current Board of Directors caused the deterioration by “Failing to instill a culture of accountability,”; “Failing to properly plan for leadership succession,”; “Failing to align incentives with shareholders by personally owning very little Disney Stock… and are extremely busy elsewhere”; and “Failing to heed constructive shareholder input.” The accompanying proxy statement dives into further detail about how his camp feels like his ascension to the Board of Directors or his son’s is the only way to save Disney from itself, stating plainly that they are not looking to replace Bob Iger or break up The Walt Disney Company.

The Walt Disney Company’s letter advised shareholders to wait until they receive Disney’s official voting materials in lieu of the Annual Meeting of the Shareholders, saying, in part,

“Your Board does not endorse Mr. Peltz (or his son) as a nominee and believes that his election would threaten our efforts to manage Disney for all shareholders. Over more than six months of engagement with Mr. Peltz, in both conversations and written materials, he has demonstrated that he does not understand Disney’s businesses and he lacks the perspective and experience to contribute to the objective of delivering shareholder value in a rapidly shifting media ecosystem.”

Disney also held its Q1 2023 Fiscal Earnings webcast on February 8, in which CEO Bob Iger and CFO Christine McCarthy outlined their own intense transformation of the company that included a reignition of accountability, a plan to appoint Iger’s successor properly, cut billions of dollars in spending, and return the dividend before the end of this calendar year (Peltz’s plan would not see the dividend return until Fiscal Year 2025). Iger also stressed the importance of returning creativity to the forefront. Peltz has made it clear that Iger’s plans are more than satisfactory.

“Now Disney plans to do everything we wanted them to do,” Peltz said on CNBC’s “Squawk on the Street” on Thursday. “We wish the very best to Bob [Iger], this management team and the board. We will be watching. We will be rooting.”

“The proxy fight is over,” Peltz said.

The Walt Disney Company’s Proxy Policy

At the Annual Meeting of the Shareholders, everyone who owns Disney stock gets a say. One share equals one vote. Proxy ensures that everybody votes whether they want to or not. Under normal circumstances, individual shareholders are able to vote after they get the official information and white proxy card from The Walt Disney Company. The ballot usually contains decisions to be made on Board Member re-elections, and official proposals put forth by concerned shareholders. It can even feature special decisions like Disney’s merger with 21st Century Fox.

However, not every shareholder is personally active in their Disney investment, so the Board of Directors has found ways to take action. In plain English, each item on the voting card will come with advisement from Disney’s Board. It will say something like “the Board recommends voting ‘FOR’ or AGAINST.’” If a shareholder does not vote, then his or her proxy will automatically be absorbed by the Board of Directors who will use those shares to sway the vote in their favor.

It is this automatic domination that Peltz and Trian were looking to counter with the distribution of the Blue Universal Proxy Cards. It states, “If this proxy card is signed and returned, it will be voted in accordance with your instructions… If you do not mark a vote on any of the proposals on the Blue Universal Proxy Card, the named proxies (listed above) will exercise their discretion to cause your proxy to be voted ‘FOR’ Nelson Peltz,” as well as their way on all other voting matters.

It is unclear at this time how many proxy cards Peltz and Trian have already received, and what will happen to those shareholders’ opinions.

Shareholders of The Walt Disney Company will receive important voting information and proper voting cards in the coming days. Disney’s Annual Meeting of the Shareholders is set to take place on Monday, April 3, 2023.