When we were all children, we all had that one stuffed animal that made us feel comfortable when something went wrong. We had a bad dream; we held the stuffed animal close. When thundering and lightning struck outside, we would hide under the bed with our beloved stuffed animal. It brought us comfort during rough patches, but eventually, we all, hopefully, outgrew that stuffed animal and moved on with our lives.

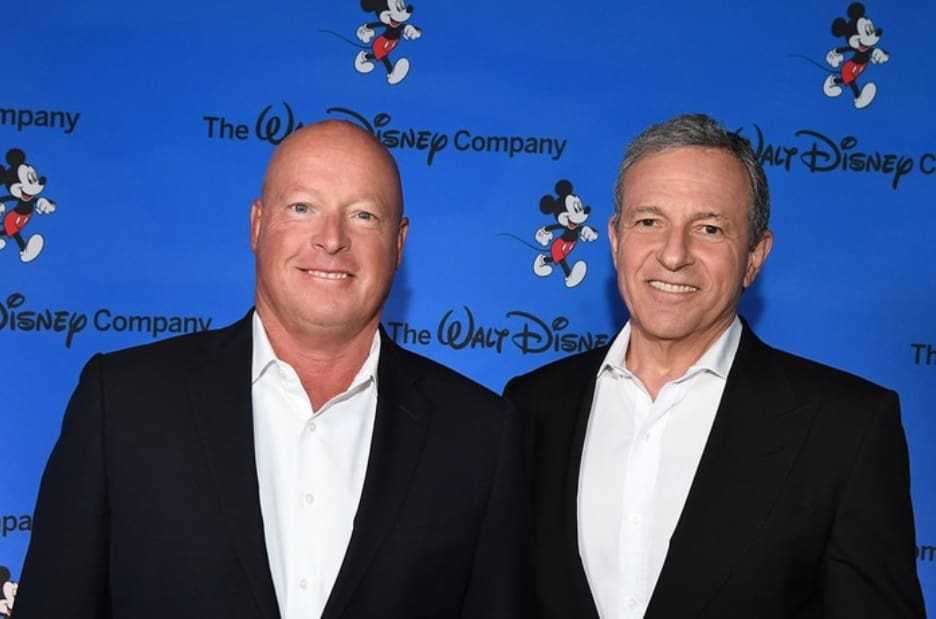

Disney CEO Bob Iger has become that stuffed animal to the Disney Board of Directors. When the world became dangerous because of Covid, or the scary way former CEO Bob Chapek was ruining what Iger built, the Disney Board turned back to Bob Iger to ensure everything would be okay.

Related: Here Lies “Chapek Era Disney….”

But was that the best strategy? A new article on Yahoo! Finance argues that bringing back Iger as CEO, or any boomerang CEO, shows a “failure of corporate leadership” and does not often bring about the intended results.

While the Chapek era at the Walt Disney Company was a disaster at best, Chris Bingham, a distinguished professor and area chair of strategy and entrepreneurship at the University of North Carolina, believes it wasn’t entirely Bob Chapek’s fault. When Iger retired, he remained chairman of Disney’s Board of Directors, making him Chapek’s boss. When Iger disagreed with some of the moves that Chapek made, which admittedly was easy to do, Iger was able to undermine his hand-picked successor and ultimately got the job back.

It became the safe and easy pick to bring Iger back as CEO. After all, his time as Disney’s leader brought unprecedented growth, including the acquisitions of Marvel, LucasFilm, Pixar, and 20th Century Fox.

But Bingham argues that bringing back a former CEO, hoping for the glory of past results, doesn’t often work. He found that from 1992 to 2017, the annual stock performance of a boomerang CEO was 10.1 percent lower than that of new or first-time CEOs at the same company.

If the past is precedent, in its desire to rid itself of Chapek, Disney may hurt its stock value. Bingham also argues that in a rapidly changing business world, even a few months away and dramatically alters the structure of a company, the CEO may not be returning to the same corporate structure that he left.

Bingham said:

The more dynamism you’re facing in an industry, the faster that knowledge or skill set is going to become outdated and obsolete. In accounting, we call it depreciation. That’s not the right way to do it. They’ve served their useful life just like any other good asset, and it’s time to replace them.

In his brief time returning as Disney CEO, Bob Iger has already started making drastic company changes. He began the layoff process of 7,000 workers, saving Disney $5.5 billion. He has created three separate divisions within the company, announced several new movie productions and sequels, and brought back free parking at Walt Disney World Resort hotels.

But there are still several things left on Iger’s agenda, including finding a successor. His contract with the Walt Disney Company runs out at the end of 2024.

Only time will tell if Disney made the right call in bringing back Iger as CEO. The returns so far have been positive, but there is still work to be done.

We will keep up updated on this story at Disney Fanatic.