The Walt Disney Co. stock price has been on a downward trend all year, and on April 20, it sunk to a new 52-week low. Measuring Year-to-Date, DIS is down around 20% or ~$32/share, and over 31% or $58/share since April 20, 2021.

Now, this news comes on the heels of weeks of fan outrage sparked by leaked footage of Disney executives’ “aggressive” push towards a “not-at-all-secret gay agenda” in its future children’s programming and actively fight to revoke Florida’s recent “Parental Rights in Education” legislation among other things. The outrage has sparked protests and scores of people announcing the cancelation of their Disney World Vacations and Disney+ subscriptions.

But at this time, it is very uncertain if this Disney fan revolt is what is causing the stock price to drop. There are several other factors at play, and this reporter felt it prudent to share three of the biggest issues affecting the company in ways that could be hiding the true damage boycotts and outrage are causing.

Two Resorts Closed Again: Hong Kong and Shanghai

2022 just barely got started when the Hong Kong Disneyland Resort announced that it was closing due to its government’s response to a resurgence of COVID-19. While the Disney Parks announced reopening in late April, Disney Parks Experiences and Products still had to carry the burden of another multi-month shut down of a whole Resort.

Then, in March, it was announced that the Shanghai Disney Resort was also closing due to a resurgence in COVID-19. With no reopening date in sight, Shanghai Disneyland sits closed indefinitely.

These closures have also stalled planned construction projects at both Parks. Hong Kong Disneyland is still building its Frozen-Themed land, Arendelle: The Land of Frozen, and Shanghai Disneyland is building a land themed after Disney’s Zootopia.

Disney+ Subscribers to “Plateau”

Related: Poll: 68% of Americans ‘Unlikely’ to Stay with Disney Due to Child-Focused Woke Agenda

According to Yahoo! Finance, Disney is projecting a plateau in new subscribers after its competitor Netflix announced a loss of 200,000 American subscribers in the first quarter of 2022 alone. It comes as very little surprise to this reporter that the sight of the company that pioneered the streaming industry losing subscribers for the first time in over a decade is enough to send shockwaves across the industry. But beyond that, a sole reason for Disney’s subscription plateau is officially unclear as factors like inflation and general dissatisfaction with new content continue to be reported as the deciding factors.

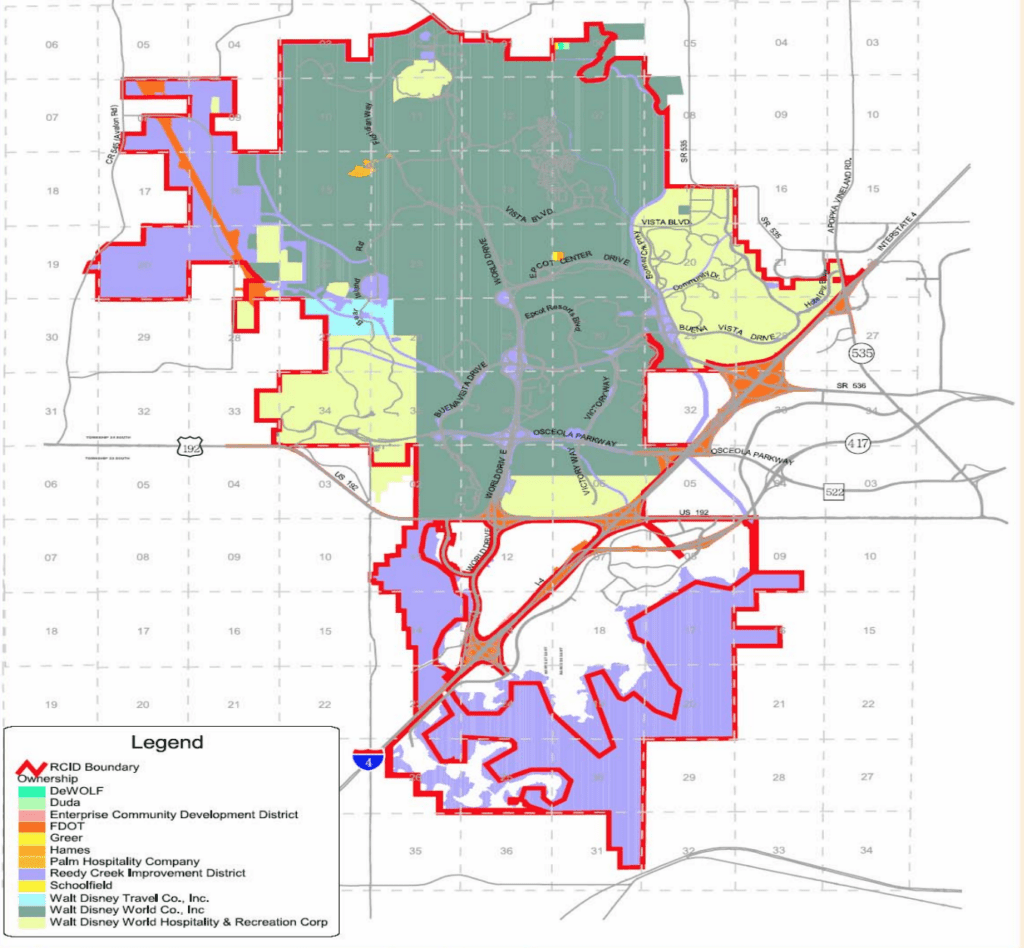

Disney World’s Reedy Creek District in Jeopardy

Read More: Florida Senate Votes to Terminate Disney World Special District

If there is one factor that can show proof of actively affecting Disney’s stock price, it is Florida’s State Government’s decision to seriously consider terminating Walt Disney World’s special state district, the Reedy Creek Improvement District (RCID). However, it is arguably more due to the uncertainty that the Mega-Resort finds itself in at the moment rather than the possible outcome. Elimination of the RCID would actually relieve The Walt Disney Company of serious financial burdens, including a long-term bond debt of just under $1 billion.

So while it is unclear at this time how much of an effect the everyday citizen is having on The Walt Disney Company, it is very likely that the specifics will come to light in the days ahead. In the meantime, we at Disney Fanatic will continue to keep an eye on Disney news and will update our readers as more developments come to light.

Please also keep in mind that this is pure speculation and we will update our readers with official Disney reports as they come to light.