We’ve all been there. You get lured into a Disney Vacation Club presentation, and it sounds fantastic. You get to own a piece of Walt Disney World and have a vacation planned every year for the foreseeable future. Who wouldn’t want that?

So, you open up your checkbook and make the purchase. But eventually, you have to leave Disney World, and that’s when reality sets in. At some point, you’ll have to pay a large sum of money for all that potential joy.

Related: New Florida Law Would Allow Disney/Universal to Work Children to the Bone

Then, the end of the year rolls around, and you get your first maintenance bill, which also includes the property tax bill. And that’s when you really start to question the wisdom of your decision.

But fear not, DVC owner, or if you happen to own another type of timeshare, the Florida Legislature has you covered. House Bill 471 would give timeshare and Disney Vacation Club owners a tax break, but the reality of the law is that it is going to benefit timeshare sellers like the Walt Disney Company or Marriot more than it will the average person.

How the Bill Works?

According to Jason Garcia at Seeking Rents, the bill would change how appraisers rate timeshares for tax purposes and lower their real-world value, thus reducing the property tax bill that timeshare and DVC club members would have to pay.

Here’s how the system currently works. Like all property taxes, an appraiser has to understand what your property is worth and does so by looking at comps in the area. It’s pretty easy to come up with a value for your home, but timeshares are a different animal altogether.

Since Disney and other timeshares work on a point system, you don’t actually own the physical property; Disney does. And it’s virtually impossible to gain a fair market value of a Disney Vacation Club membership or other timeshare because the resale market is such a mess.

Disney and other timeshare developers intentionally undercut the resale market, forcing you to buy a new timeshare from them. It is a dirty little secret of the industry.

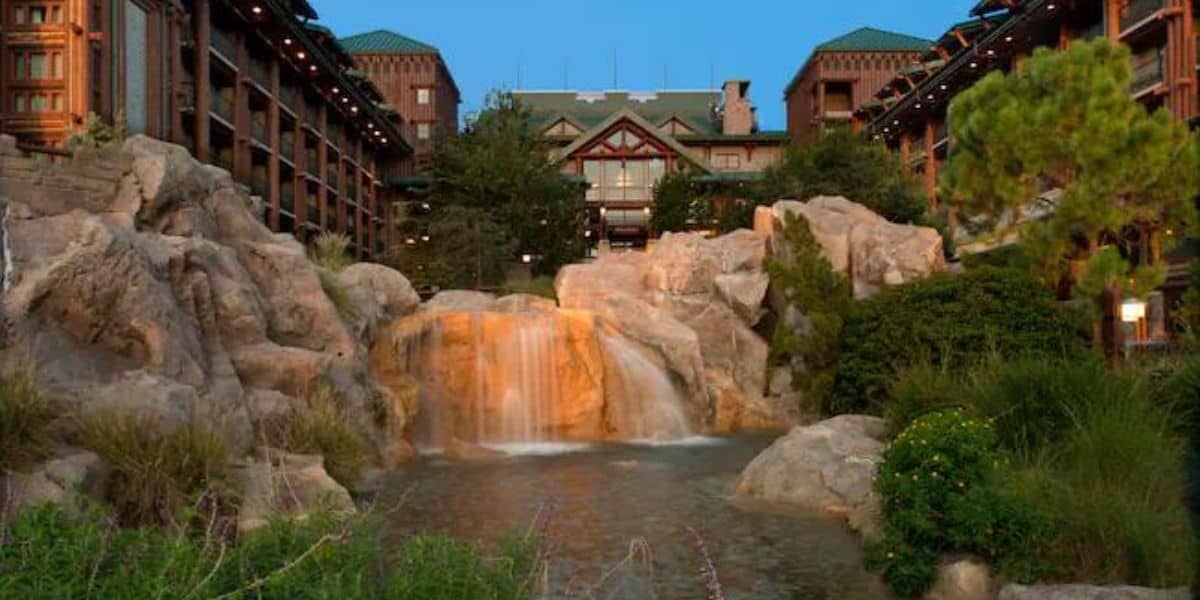

So, how does an appraiser determine the value of your DVC points to charge you property taxes on your annual dues? Simple, they look at the price that people are currently paying to buy into a Disney Vacation Club Resort.

But that number can be misleading. If you own at an older resort, as opposed to Grand Floridian, your real-world value is much lower. But this new law is going to change all that.

HB 471 would force assessors to consider new timeshare purchases and the resale value of your Disney timeshare. Garcia estimates this could lower some timeshare tax bills by up to 75 percent.

How Does This Help Disney?

The Florida Legislature estimates this bill will cost around $200 million annually in lost tax revenue. But the largest benefactor isn’t going to be your average timeshare owner from another state; it will be the large timeshare sellers in Central Florida, including Disney.

Disney is required to own at least two percent of the timeshares on a given property, but that’s not where the real savings come in.

Related: Florida’s Takeover of Disney’s Monorail System is Now Complete

It takes time to sell these properties, and while they are sitting, Disney is still paying taxes on them. Garcia looked at the Disney Vacation Club at the Grand Floridian. Only half of the available units are sold, so Disney is paying taxes on the other half.

This could save Disney World millions of dollars a year just in property taxes and maybe a few bucks for you.

Does this bill help Florida? No, but it helps the timeshare developers like Disney and Marriot, who own massive properties in Central Florida.

So, if you happen to be a timeshare owner, thank the Florida Legislature for your new tax break.

What do you think about this tax break? Let us know in the comments.

DisneyFanatic.com The Latest News, Advice, and Perspective from Disney Fans for Disney Fans!

DisneyFanatic.com The Latest News, Advice, and Perspective from Disney Fans for Disney Fans!