Disney Parks’ latest round of price hikes is just the latest move of a year-long corporate route blatantly directed towards optimization of cash flow into The Walt Disney Company’s coffers. It is one thing to raise ticket prices, but Disney’s obvious push for short-term profits across the corporate umbrella is starting to smell like desperation for an immediate increase in cash flow.

Sure, Disney has always been a for-profit company that offers innovative and expensive experiences, but what has been happening recently is NOT normal. The pandemic caused Disney to take on a lot of debt to stay afloat, and now this writer is starting to ask, what are we missing? Is Chapek really this ‘greedy,’ or is the company’s debt situation really THAT bad?

Disney’s Noticeably Rapid Profit Optimization

Along with the overt increases in Disneyland Ticket Prices and the cost of Disney Genie+ and Lightning Lane access there and at Walt Disney World Resort, hotel rates have steadily skyrocketed at both domestic locations, and an emphasis has been placed on attracting non-local and non-Annual-Passholder Guests in order to maximize the amount of short term spending recorded per Guest. For example, every single tier of Disneyland’s annual pass, the Magic Key, has blackout dates.

Meanwhile, the Theme Park Experience is filled with tell-tale signs that the powers that be are still trying to keep their belts tight. Park-related construction projects first announced over three years ago have slowed, stalled, or even been suspended indefinitely. Transportation means such as supplementary bus transportation from the boat-, monorail-, and skyline-accessible Resort hotels (ex., Buses to Magic Kingdom from Disney’s Polynesian Resort and Buses to EPCOT from Disney’s BoardWalk Resort) have yet to return. Disney Magical Express has also been canceled. Select experiences like Fantasmic! still have not returned to the Parks, and one has to wonder: is it really due to COVID-related excuses, or do they not want to–or are they unable to–spend the money?

Disney Fanatics seem to be excited about the return of beloved experiences like Disneyland’s daytime parade, “Magic Happens,” and Disney World’s fireworks spectacular “Happily Ever After.” But at the end of the day, these are opportunistic “positive recycling” decisions that eliminate development costs while potentially increasing Park attendance. The announcement of new stuff has been methodical and arguably frugal as well. The biggest example of this frugality is Disney’s decision to give Disneyland Resort a new fireworks show and revised edition of “World of Color” for the Disney100 celebration while leaving its Tomorrowland–and the ruins of its PeopleMover track–in a state of obvious decay. Disney Cruise Line was also able to expand to Australia by sending its second-smallest ship to tend to ultra-luxurious boutique cruises, while the new largest ship in the fleet is able to deliver more Guests at a time on the most popular Castaway Cay/Bahamas/Caribbean routes.

Financial optimization is also plainly visible elsewhere in The Walt Disney Company. More and more feature films continue to forego a traditional theatrical release for a much-less-expensive Disney+ launch. Disney CEO Bob Chapek announced that the flagship streaming service will now have an ad-supported tier. This move creates a “more affordable” version of Disney+, an avenue to accumulate massive amounts of ad revenue and justify an increase in the original, ad-free version of the platform. Chapek also recently suggested that the potential for ad revenue is the primary reason Disney is deadset on retaining ESPN and its overall stake in the world of professional sports. Also, gambling is now going to be an aspect of Disney.

The Walt Disney Company also still has not restored dividend payments to its shareholders.

What is going on?

Disney’s Pandemic Debt

Well, when most of the world’s leaders used COVID to justify bringing everything to a screeching halt for a then-indefinite amount of time, The Walt Disney Company was hit hard. Less than a year after it announced some of its most aggressive expansion efforts regarding Theme Parks, Disney Cruise Line, and Disney+, all of the Parks, Cruises, and studios were shuttered all over the world.

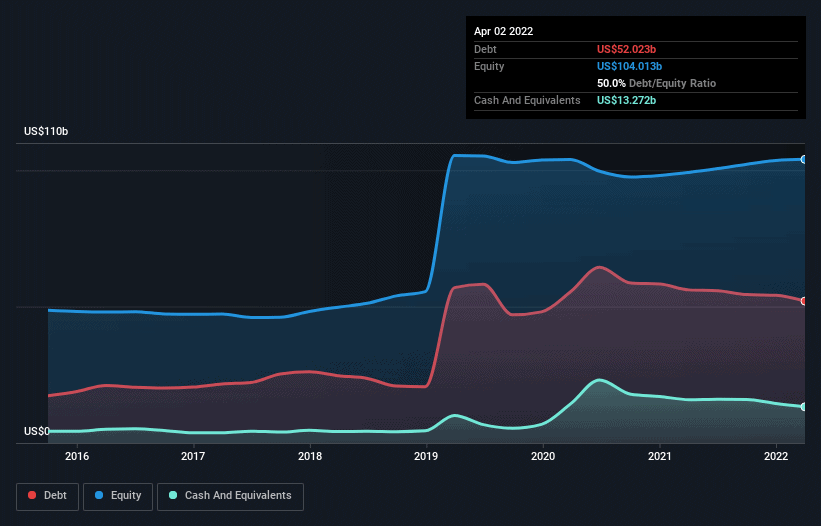

This meant that Disney needed to take on massive amounts of debt in order to stay together. In 2020, Disney’s long-term debt spiked over 38% to $52.917 billion. While the company has continued to make steady payments to pay off that debt, and its total value is still significantly higher–measuring out at around $193.3 billion as of August 2022–the company had liabilities of US$29.6b due within 12 months and liabilities of US$68.8b due beyond that, putting the total amount owed at $71.4 billion with $13.3 billion in cash and an expected $13.7 billion in receivables due in the next 12 months.

While Disney’s equity is still valued at more than double the debt owed, its ability to curb the deficit rests on its ability to bring in fast cash both in matters of profitability and free cash flow.

This is where Bob Chapek comes in and why he will be remembered as a hero–whether we like it or not.

Bob Iger was a man whose leadership can be defined by “open expansion.” The times were good! In his 15-year tenure, he instituted efforts to save three Theme Parks (Hong Kong Disneyland, Disney California Adventure, and Walt Disney Studios Park), he spearheaded the absorption of Marvel Studios, Lucasfilm, and 20th Century Fox, and he proved to be a pioneer of international business by making a Disney Theme Park the first Theme Park to be built and run by an American company in Mainland China.

But the lockdowns brought those times to a sudden end. Disney needed a bulldog who could do what needed to be done to financially keep The Mouse House afloat, regardless of what the previously pampered populous of Disney Fanatics would say. That man was Bob Chapek. He and his CFO Christine McCarthy piloted the Disney ship through the tumultuous waters, optimizing the profits and cash flow in order to not only stay alive but maintain an image of corporate confidence.

Can Disney Keep the Cash Flow Going?

However, that revenue stream has turned into rapids this year amid more rapid expansion on the streaming front, as well as socio-political controversies and debates, and there appear to be three distinct and divided markets forming. On the one hand, they have the traditionalist middle-class, Middle-America fans who are not happy with the direction Disney has taken this year. On another hand, there are the childless millennials and general “Disney Adults” who have their own adult money to share now and who seemingly have no intention of putting other kids’ experiences into consideration. And on another hand–loosely tied to the “Disney Adults”–are the left-wing “conscious consumers.” These are arguably the most vocal and energetic consumers who equate their money spending to making political contributions to any groups pushing their agendas (which might also explain Disney’s push for things like Environmental Social Governance (ESG), push against Florida’s Parental Rights in Education Law, and “Reimagine Tomorrow”).

Related: DeSantis Strikes Twice: Signed Bill Could Prohibit ‘Reimagine Tomorrow’ at Disney World

Yes, there is a legitimate concern that the price increases will cut out a lot of families for the time being. Yes, there are most likely a lot of families choosing to walk away from Disney. And it should be noted that this business issue comes chronologically after the pandemic-induced debt situation came to be. These latest reasons are not the cause of the debt but rather a possible inhibitor in recovery efforts.

But hopefully, the quality increases will match the price increases, and Disney can cut through the divisive nonsense and maximize profits off of those rich enough, apathetic enough, and dedicated enough to experience whatever Disney magic is still available right now to produce a better, more affordable tomorrow.

The Pandemic may be over. But, The Walt Disney Company still appears to be in a strained financial position. We are not out of the woods yet. The ugly bulldog still has work to do.

Personally, if The Walt Disney Company can deliver on the old Disney-Standard level of quality while cutting out all of the temptation to be politically divisive, there is not a doubt in my mind that there is a Happily Ever After to this story we are all living right now.

“THE LION KING”

(L-R) Simba (voice by Matthew Broderick), Rafiki (voice by Robert Guillaume), Kiara, Nala (voice by Moira Kelly)

©Disney Enterprises, Inc. All Rights Reserved.

Disclaimer: Any opinions expressed in this article are the writer’s and may not reflect the sentiments of Disney Fanatic as a whole.